Maryland Annual Report

Stay Compliant with Managed Annual Report Service

- Save time! Maintain a single online company profile that we use to file annual reports nationwide.

- Ensure on-time filing. Our software tracks due dates and files reports on time to maintain good standing and avoid late fees.

- Enjoy total visibility. See due dates, filing status, approved documents, and more in Entity Manager.

Annual fees from $100 to $175 per state plus filing fees.

Maryland Annual Report Information

Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

State agencies do not provide consistent reminders when annual reports are due. As a result, you may be tracking your company’s annual report due dates on your own. Perhaps you received a letter from the state telling you an annual report is coming due, or worse, overdue.

This page provides information about how to file a Maryland annual report. Our handy reference table will provide you with the Maryland annual report due dates and filing fees for each entity type. We also offer Managed Annual Report Service to offload your annual reports entirely. We track your due dates and file on time, every time.

- Jump To:

- Maryland Annual Report Information

- What Is an Annual Report?

- Why Is a Maryland Annual Report Required?

- How Do I File a Maryland Annual Report?

- Where Do I File a Maryland Annual Report?

- When Is a Maryland Annual Report Due?

- What Is the Maryland Annual Report Filing Fee?

- Who Can File a Maryland Annual Report?

- Maryland Annual Report Requirements by Entity Type

- Annual Report Requirements by State

What Is an Annual Report?

Annual reports are required business filings, typically made with the secretary of state. In most states, companies submit any changes to their address, ownership and officers, and registered agent. Some states require additional information about revenue, assets, stock, and paid-in capital.

Tracking due dates in multiple states and filing on time is often challenging. A company that registers in multiple states will have due dates at different times throughout the year. In some states, they may be required to file every two years (biennially).

Companies spend countless resources managing annual reports on their own. Tracking deadlines, gathering information, navigating forms and online filing portals, and submitting reports on time requires constant attention throughout the year. The complexity only increases for companies with multiple entities or that register in multiple states. Furthermore, most companies rely on spreadsheets, calendar reminders, and file folders to manage their annual reports.

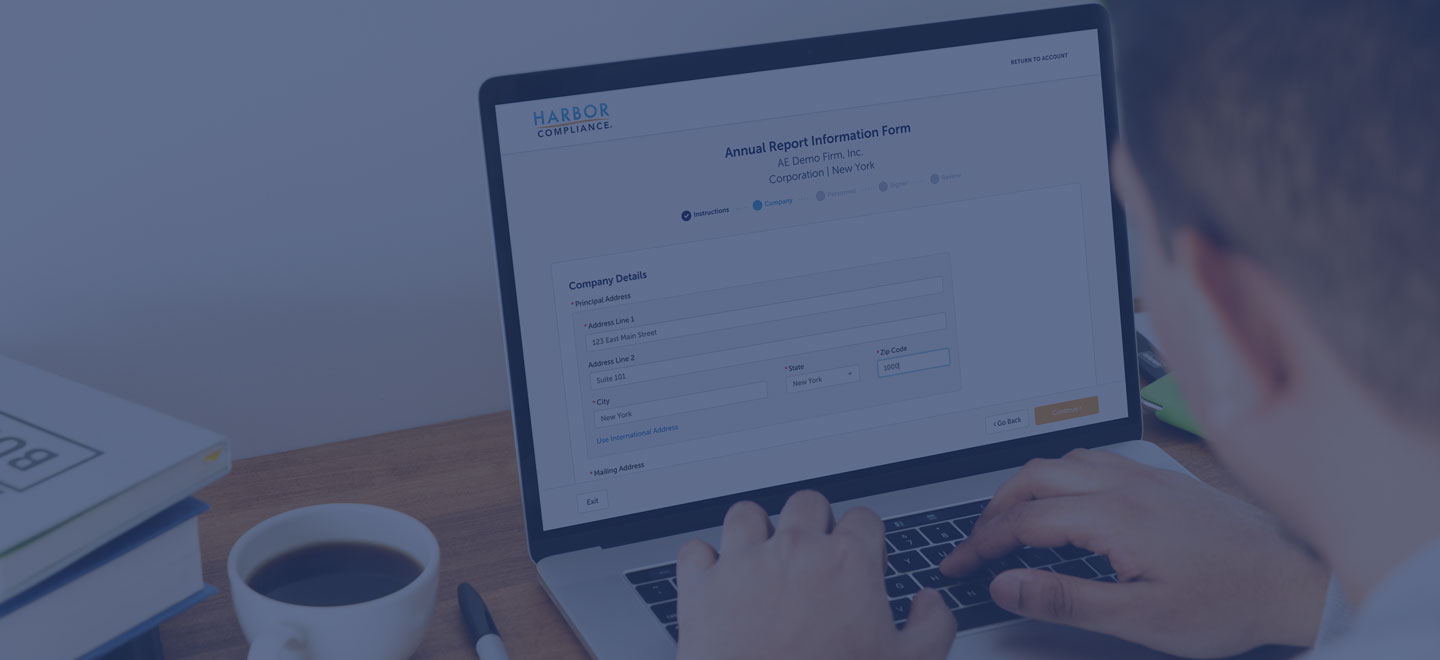

With Harbor Compliance’s Managed Annual Report Service, we provide cloud-based software to view entity data, store corporate records, and ensure business continuity in a virtual world.

Why Is a Maryland Annual Report Required?

Annual reports are required by statute in nearly every state. They provide state agencies with updated information on the entities registered in their state. Your company is required to file annual reports to maintain good standing and continue operating.

Failure to file annual reports on time can result in late fees. Most states enforce additional penalties on lapsed entities. These include the loss of naming rights, loss of access to the courts, and administrative dissolution. Many banks, licensing agencies, and even prospective clients require evidence that a business is in good standing. By filing annual reports each year on time, companies avoid the costly and potentially embarrassing consequences of noncompliance.

How Do I File a Maryland Annual Report?

There are two ways to file a Maryland annual report.

- If you plan to file your Maryland Annual Report on your own, view the table below for the available filing methods for your type of legal entity. We also provide links to forms and agency filing portals.

- Sign up for Managed Annual Report Service. Simply provide your information one time and update it with us when it changes. Our software tracks your due dates and automatically files your annual reports throughout the year.

Where Do I File a Maryland Annual Report?

Annual Reports are filed with the Maryland State Department of Assessments and Taxation (SDAT). To view your entity registration and confirm your due date, use the corporation filing authority's business search feature and search for your entity.

When Is a Maryland Annual Report Due?

Annual report due dates depends on the type of entity you have and whether your business is domestic or foreign to Maryland. In many cases, the annual report deadline is based on the date you form or register with the state. View the table below to find the due dates for your state.

Harbor Compliance’s software directly integrates with secretary of state databases. With our Managed Annual Report Service, we use your entity data to track your annual report due dates accurately and file on time, every time.

What Is the Maryland Annual Report Filing Fee?

Annual report filing fees depend on the type of entity you have and whether your business is domestic or foreign to Maryland. View the table below to find the filing fees for your state.

With our Managed Annual Report Service, you no longer have to calculate your fee or remit payment to multiple agencies. Our software calculates your exact filing fee. We simply invoice your filing fee 90 days before your report due date directly within your Client Portal.

Who Can File a Maryland Annual Report?

Anyone with authority to prepare and submit business filings can file a Maryland Annual Report. However, ensuring compliance across entities and jurisdictions creates complexity.

Harbor Compliance simplifies your annual report compliance. Our Managed Annual Report Service replaces legacy systems for tracking due dates and filing annual reports. We eliminate your need to research requirements, create due date reminders, and navigate government forms and filing portals.

Our service maximizes your time savings and ensures accuracy in filing. When you sign up, we conduct an initial review of your entity registrations to identify noncompliance. We offer additional services to prepare and file overdue reports, register entities, and reinstate them into good standing.

We minimize the amount of information you provide to us. Simply enter your company data into a secure, web-based form, and update it only when it changes. We use that information to file your reports automatically throughout the year. Entity Manager Software tracks annual report due dates and calculates filing fees across all states and entities. Enjoy immediate visibility into registration data, entity statuses, and upcoming due dates.

Maryland Annual Report Requirements by Entity Type

See the table below for information on filing an annual report in Maryland. Select your entity type to view your Maryland annual report filing fee and due date.

Maryland Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: | |

| Penalties: | If your business has property in Maryland, then the late fee is a percentage of your county assessment plus interest. If your business does not have property in Maryland, then there is no late fee. All businesses risk dissolution or revocation. |

| Notes: |

|

Maryland Limited Liability Company Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: | |

| Penalties: | If your business has property in Maryland, then the late fee is a percentage of your county assessment plus interest. If your business does not have property in Maryland, then there is no late fee. All businesses risk dissolution or revocation. |

| Notes: |

|

Maryland Nonprofit Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: | |

| Penalties: | If your business has property in Maryland, then the late fee is a percentage of your county assessment plus interest. If your business does not have property in Maryland, then there is no late fee. All businesses risk dissolution or revocation. |

| Notes: |

|

Maryland Professional Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Penalties: | If your business has property in Maryland, then the late fee is a percentage of your county assessment plus interest. If your business does not have property in Maryland, then there is no late fee. All businesses risk dissolution or revocation. |

| Notes: |

|

Maryland Limited Partnership Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Limited Liability Partnership Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Domestic Maryland General Partnership Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Limited Liability Limited Partnership Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Benefit Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: | |

| Penalties: | If your business has property in Maryland, then the late fee is a percentage of your county assessment plus interest. If your business does not have property in Maryland, then there is no late fee. All businesses risk dissolution or revocation. |

| Notes: |

|

Domestic Maryland Close Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Original Ink: | Not required |

| Notarization Required?: | Not required |

Domestic Maryland Sole Proprietorship Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Trust Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | Either Form 1 - Annual Report and Personal Property Tax Return or Form 5 - Banks, Savings & Loans and Other Financial Institutions |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Foreign Maryland Insurance Company Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Financial Institution Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | Form 5 - Banks, Savings & Loans and Other Financial Institutions |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Benevolent Corporation Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Instructions: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $0 |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Maryland Credit Union Annual Report Requirements:

| Agency: | Maryland State Department of Assessments and Taxation (SDAT) |

| Form: | |

| Filing Method: | Mail or online. |

| Agency Fee: | $300 + processing fee of $3 for echeck or $9 for credit card if filing online. |

| Due: | Annually; must be postmarked by April 15. Reports may be filed as early as January 1. |

| Law: |

Annual Report Requirements by State