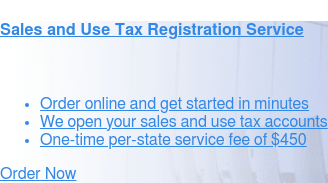

Sales Tax Compliance for eCommerce Businesses

When it comes to how products are taxed, internet sellers have experienced a lot of change throughout the past several years. This article discusses how sales tax obligations impact eCommerce sellers’ businesses and will explain what businesses must do to stay in the good graces of state and local tax authorities.

Jump To:- A Brief History of Sales Tax Nexus Laws

- Sales Tax Legislation Today

- Different Types of eCommerce Sellers

- How to Know Whether an eCommerce Sale Is Taxable

- Steps eCommerce Businesses Must Take to Be Sales Tax Compliant

- Sales Tax Risk Assessment for eCommerce Business Owners

Sales tax is tax on the consumption of goods or services. Sales tax is paid by consumers but collected by retailers, who hold it in trust until remitting it to the appropriate tax authority along with a sales tax return. People often talk about “internet sales tax” as if it’s unique—but it’s actually handled the same way as any other tax. However, tax on interstate sellers, including eCommerce sellers, has evolved a lot in recent years.

A Brief History of Sales Tax Nexus Laws

Before eCommerce existed, most interstate transactions were mail-order catalog sales. States only collected tax when catalogs sold items to customers living in a state where the seller had a physical location. North Dakota started to get frustrated by this setup because the state realized it was missing a lot of tax revenue. As a result, the state passed a law requiring all retailers that advertised to customers in North Dakota to pay sales tax—which targeted all popular catalog companies.

Not surprisingly, that legislation was met with resistance, and a big catalog company called Quill Corp refused to pay the tax. North Dakota sued the company, and the case eventually made its way to the Supreme Court. The court ruled in Quill's favor, stating that Quill did not have to pay the tax and that all companies must have a substantial physical presence in a state to be required to pay sales tax to state taxing authorities. Amazon saw this as an opportunity and began to build a tax-free online marketplace that consumers quickly embraced.

As eCommerce grew in popularity, states started getting impatient at all the money they couldn't collect tax on. In 2018, South Dakota sued online furniture retailer Wayfair, arguing that states should be able to collect tax on interstate sales in another case that made it to the Supreme Court. Ultimately, the Wayfair case overturned the Quill vs. North Dakota decision, replacing it with a ruling that opened the floodgates for states to collect tax from all sorts of businesses, regardless of physical presence.

The ruling in South Dakota vs. Wayfair, Inc. recognized that physical presence nexus by itself had become obsolete with the growth of internet businesses and sales. The ruling introduced the concept of economic nexus, which allowed states to collect sales tax on internet sales as long as sellers met certain thresholds. Not surprisingly, clothes states caught on and quickly introduced new economic nexus legislation of their own.

Sales Tax Legislation Today

Within each taxing jurisdiction, tax authorities can dictate their own tax rates, product taxability rules, exemption regulations, and filing schedules.

Here’s what the sales tax legislation landscape looks like in 2022:

- 5 states have no state-wide sales tax, including Alaska, Delaware, Montana, New Hampshire, and Oregon.

- 45 states and Washington, D.C., have both state sales tax and economic nexus legislation.

- 37 states allow local sales tax, including Alaska, which has no state sales tax.

- 6 home rule states (Alabama, Alaska, Arizona, Colorado, Idaho, and Louisiana) allow cities, counties, and special tax jurisdictions to collect and administer sales tax independently.

In total, there are more than 11,000 sales and use tax jurisdictions in the United States today, and it’s up to businesses to determine where they’re required to pay sales tax.

Different Types of eCommerce Sellers

Whether a business sells directly to consumers (B2C) or sell to other businesses (B2B), it is subject to economic nexus tax obligations. However, taxes are handled differently for remote sellers and marketplace facilitators.

Remote Seller

A remote seller is any person or business making sales into any state outside of their home state that does not have physical nexus in those states. This definition applies to any eCommerce seller that sells products from their own website or selling platform and ships them into other states. Remote sellers must be aware of when and where they trigger economic nexus and must collect and remit sales tax (Remote Seller Tax) to each nexus state to remain compliant.

Marketplace Facilitator

Marketplace facilitators are online marketplaces (Amazon, Walmart, Etsy, and eBay) that list, collect payment for, and fulfill orders on behalf of a third-party seller. Today, most states require marketplace facilitators to register, collect and remit marketplace facilitator tax and handle reporting on behalf of individual sellers.

For example, California marketplace facilitator nexus legislation states, "Beginning October 1, 2019, a marketplace facilitator is generally responsible for collecting, reporting, and paying the tax on retail sales made through their marketplace for delivery to California customers. A marketplace includes a physical or online place where marketplace sellers sell or offer for sale tangible merchandise for delivery in California. A marketplace facilitator is generally the operator of the marketplace."

This was a big win for small eCommerce sellers who found themselves facing a massive tax burden since the economic nexus was born. However, it's important that businesses know which category they fall into and are able to verify whether they responsible for anaging nexus obligations or if their marketplace facilitator platform handles tax compliance on its behalf.

Rather than making any assumptions, businesses must confirm whether the tool or platform they use to sell their products is considered a true marketplace facilitator versus an eCommerce tool. True marketplace facilitators handle tax, but many eCommerce tools will not remit taxes without a third-party integration.

How to Know Whether an eCommerce Sale Is Taxable

Businesses must consider two key things to determine whether a particular eCommerce sale is taxable.

eCommerce sellers must pay sales tax on internet transactions when:

- They sell to a customer in a state where their business has sales tax nexus.

- The product the business sells is taxable in the state it sells into.

The good news for small eCommerce sellers is that they have to reach a certain threshold, typically around $100,000 in sales or 200 transactions, to trigger economic nexus. If the business doesn’t do enough sales volume in a particular state to be held accountable for sales tax, it generally does not have to go through the process of registering, collecting, remitting, and reporting.

However, businesses should read legislation carefully and watch how states are using the words “and” and “or.” In some states, sellers must meet the economic threshold or the transaction count threshold. In others, sellers must meet both criteria (and) to trigger nexus. In some states, marketplace facilitator sales count toward threshold calculations, but in others, they are excluded.

Steps eCommerce Businesses Must Take to Be Sales Tax Compliant

Navigating sales tax requirements is complex. eCommerce businesses generally must:

- Identify every state where their business has sales tax nexus.

- Register in every state where their business triggers nexus.

- Accurately calculate sales tax on every applicable transaction.

- Collect and securely store tax monies until business taxes are filed.

- Correctly report sales tax in applicable states on a predefined filing schedule.

- Remit tax payments to every state where nexus has been triggered.

Sales Tax Risk Assessment for eCommerce Business Owners

Businesses that have significant sales volume each year and which sell outside of marketplace facilitator platforms may have unmet nexus obligations. Fill out this quick, no-cost compliance risk assessment to see where you stand.

Continue reading “5 High-Risk Industries Targeted by State Sales Tax Compliance Auditors”